The New Zealand Retirement Villages Association has joint ventured with us to take our ongoing professional development program to New …

Here is something to put in the back of your mind. Our DCM group colleague Chris Baynes is giving a …

Last week, the Property Council Retirement Living Committee held their first face-to-face committee meeting since the beginning of the pandemic …

Thank you for supporting us! What a huge achievement by the DCM Institute team to be moving into our third …

It would appear that the shadow of the June 2017 Four Corners retirement village exposé is finally behind us, with …

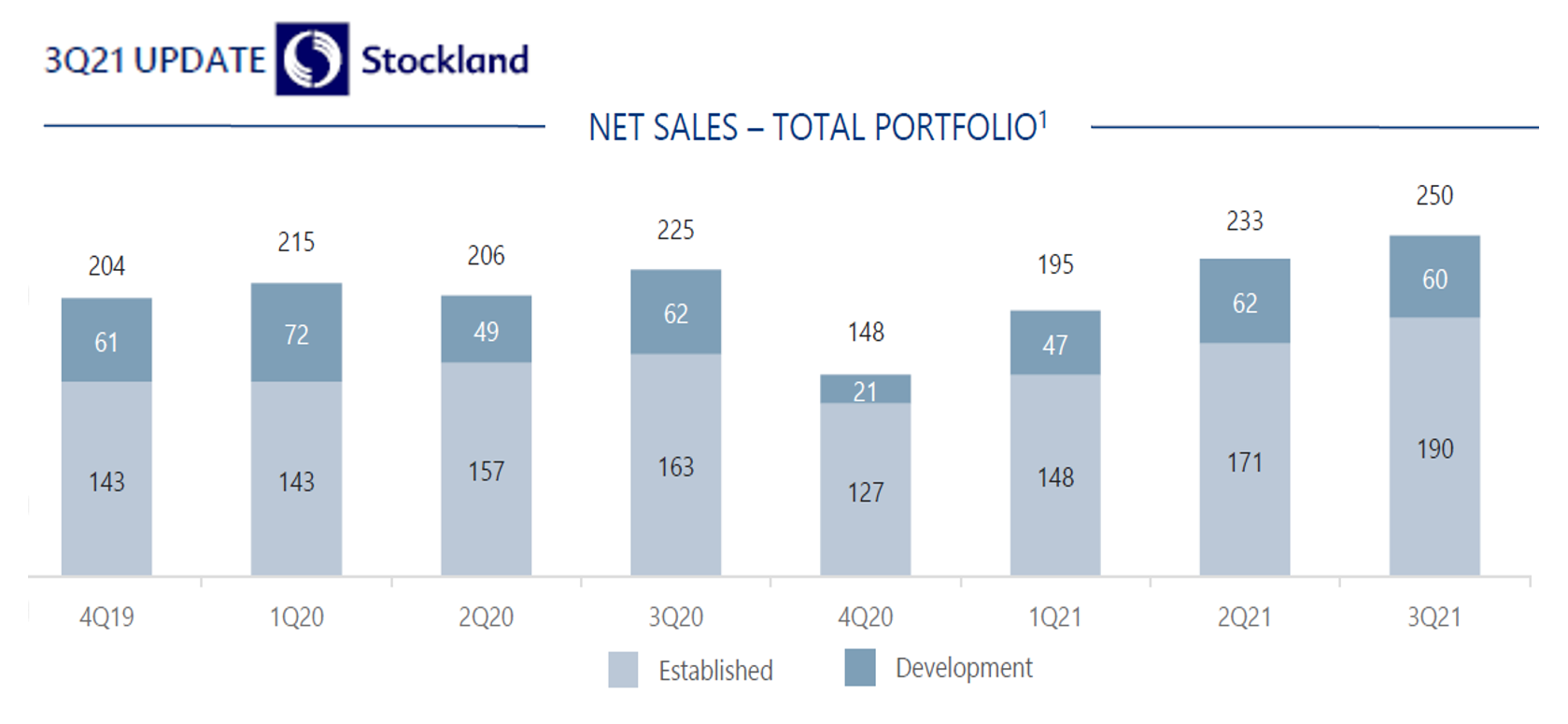

Stockland is expanding its participation in the Over 55s housing market with ambitions to open 10 land lease communities in …

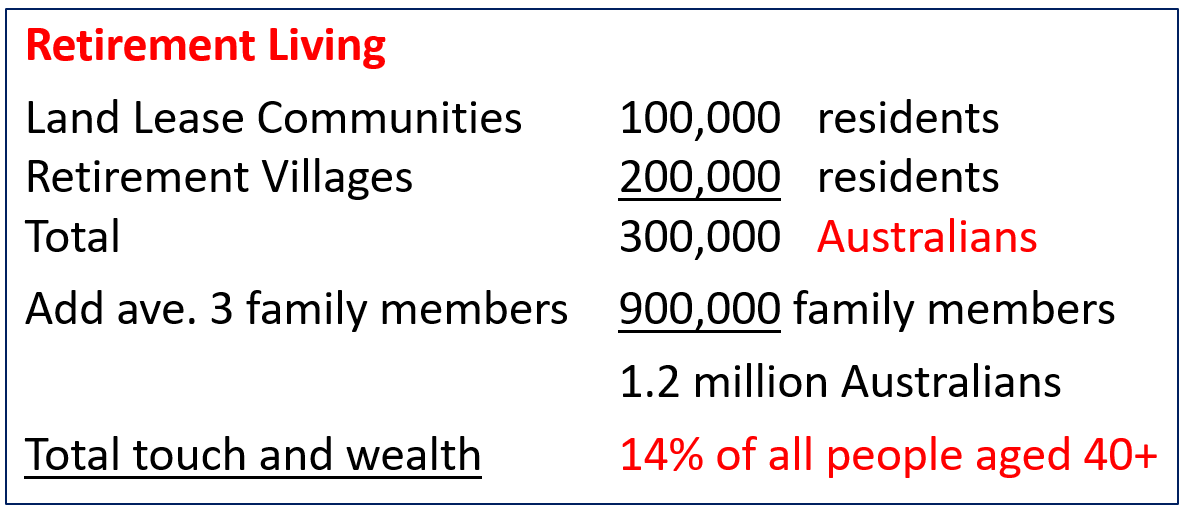

At times we need to take a step back and think of the sector we work in and the impact …

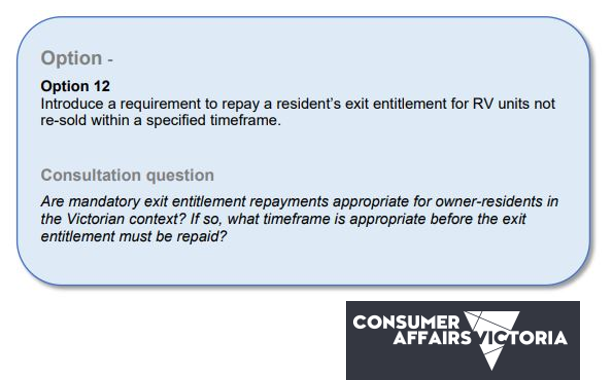

It’s a fight between QLD and NSW on which Government is going to introduce a new round of village regulations …

If you do one thing in the lead up to the May Federal Budget – grab yourself a coffee and …

Are your residents wanting a new indoor bowls mat or would they like to learn how to use their smartphone …

Each year, our peak industry bodies seek nominations for the Village Manager of the Year in each state, with the …

Independent Living Assessment (ILA) is seeking expressions of interest from Australian communities and organisations interested in setting up a Village …