Volunteering plays an important role in retirement village and age care around the country. This week, we look at some success stories for National Volunteers Week.

Our colleague Jake Nelson wrote this article on Tuesday in the SOURCE. We thought it may interest you if you …

Historically retirement villages have not engaged in food service because residents are independent, meaning they can prepare their own meals …

It will be no surprise to you that many village residents struggle with the internet, and this makes life hard for …

Here is something to put in the back of your mind. Our DCM group colleague Chris Baynes is giving a …

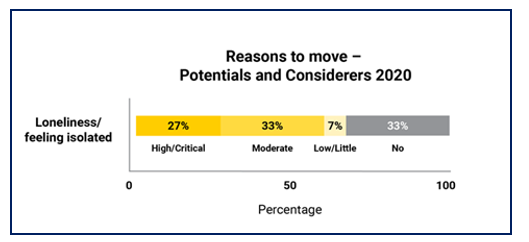

Our sister company DCM Research has just completed the DCM Prospect Profile survey of 2,207 people aged 60+, and we’ve …

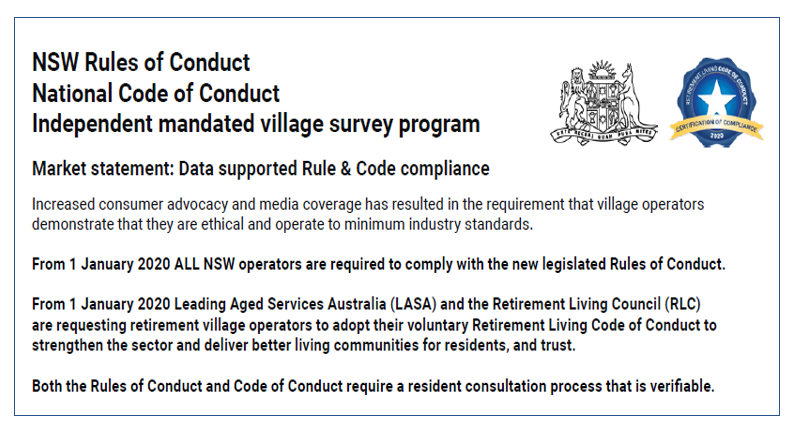

It’s time of year where many operators need to consider their requirements under regulations, the Code of Conduct or Accreditation …

The upcoming PwC/Property Council Retirement Census is open and just around the corner. It’s open to all Australian retirement village operators …

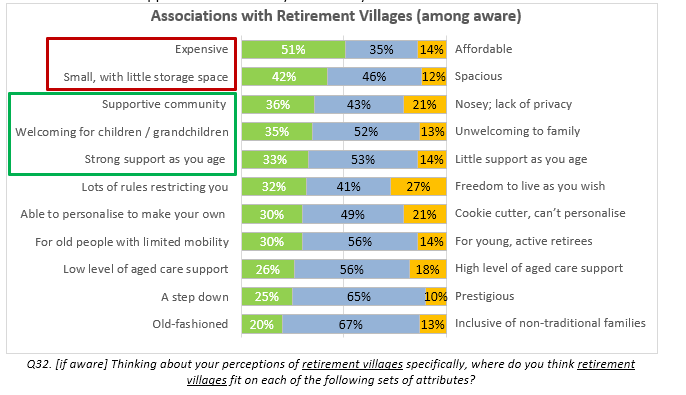

Our sister company DCM Research has been undertaking a project to understand the attitudes and motivations for people moving into …

Over the past three months we have been working with operators and peak bodies to design the optimum market research …

Collectively, I believe as a sector we need to use this unique opportunity that has been presented to us by …

On a weekly basis, I am delighted to receive emails from participants in the Village Management Professional Development program about …