The big three private operators have just released their sales results for the last 12 months after the Four Corners TV program of27 June (2017) that caused sales to crash.

For 2017/8 Aveo resales were down 38%, Lendlease down 26% and Stockland down 23%.

Only now is new customer enquiry getting back to pre Four Corners levels.

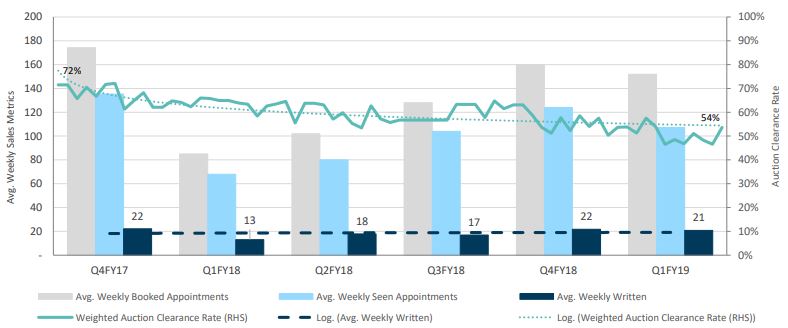

See the Aveo chart above.

The sales conversion ratio used to be one in three, meaning for every three people that visited the village as a potential customer, one would buy. A conversion rate of 33%.

Our estimate, based on regularly talking to operators across the country, is that 25% of operators are still achieving sales at this rate. (Yesterday I was at Mount Gilead village outside of Sydney and they are building and selling 10 to 12 new homes a month!).

The big operators aren’t. The Aveo chart shows they need to make 22 sales a week across the country to clear the turnover of their existing village homes.

Before the TV program they had to make 175 appointments each week, with 135 people actually turning up at the village to give them actual 22 sales.

This equates to a ratio of 16% or one in six people who ‘walk down the drive’.

Aveo is now getting fewer people down that drive but their success is up to one in five, or 20%.

All reports say that these potential customers now have their adult children with them who want a clear explanation of the contracts.

So each sale requires considerably more time. Is this your experience?

If sales have been slow then you most probably have a buildup of stock to sell, with unhappy families waiting for their cash.

What you need is fewer but higher quality potential customers, not ‘tyre kickers’ that take your time.

You need to have a sales ratio of at least one in three.

Our website villages.com.au delivers 800,000 people a year who are genuinely thinking about and searching for retirement villages. We carry every retirement village in Australia on the website for free but to really work requires a promotional listing at $800 for 12 months.

If you have a promotional listing, then thanks. But when did you last look at it and update to better quality photographs, sales points, and pricing?

Good quality listings will generate you better quality enquiries and faster sales.

If you need a hand with this, email us at info@docomemonday.com.au or call us on 02 9555 9576.